An online industry briefing will be held on September 23 for would-be bidders. It's set for 12am. If this is not a misprint, I suppose midnight is more attractive to foreign bidders.

Intending operators need to submit an expression of interest (EOI) by October 19. Then the serious bidders really start cracking. After a call for proposals (RFP) in December they need to be in by April 2021. The government evaluates them and announces the successful tenderer in September 2021. This sets in train the transition arrangements (if needed). Any new franchisee will start in January 2022.

Nine news report from Monday says that improved passenger information and new technology will be priorities. Significantly, 2022 is an election year. If preparation with the new or returned franchisee starts early it should be possible to deliver some pre-election network upgrades in that year. Nothing's been promised. Although one might speculate about precursor network changes that prepare for high-profile projects such as the electorally popular Suburban Rail Loop and/or Airport Rail.

What do we know about the new franchise agreement? A lot of information is in the Invitation to Expression of Interest on the Tenders Vic website. That came out on Wednesday. This is split into two documents - General Information and Returnables.

What's there now

The current franchise, which started in 2013, is run by Transdev Melbourne. Key statistics (from the General Information document) are as follows:

* 49 network routes and 134 school routes operating 36 million km pa

* 527 buses housed in 6 depots with an operations control centre

* 1267 full time equivalent employees including 1064 drivers and 100 maintenance staff

All up it covers about 30% of the Melbourne network. As mentioned before these include Melbourne's most frequent and longest hours bus services including many CBD routes and most SmartBuses including all orbitals and DART services. Plus other trunk and local routes that can trace their histories back to MetBus and further back.

The agreement with Transdev included an obligation for the franchisee to develop a new greenfields network (they did but the government rejected it) and rewards and penalties for patronage and reliability. There had been improvements on reliability but even pre-COVID 19 they were struggling on the patronage front (PTV tried a 'Melbourne by Bus' marketing campaign with some nice posters but it didn't seem to work).

New service initiatives

Under this government bus network reform has rarely been done for its own sake. That's despite low costs and significant benefits. Even level crossing removals and new stations like Reservoir and Southland included nothing more than minor stop relocations, notwithstanding opportunities for simpler and better connected local bus networks.

Our largest projects, in contrast, will likely trigger bus network reform. Those named in the invitation document include the West Gate Tunnel, Metro Tunnel, North-East Link (including its dedicated busway) and the Suburban Rail Loop. It is even said that as a precursor to rail "consideration may be given to aligning orbital routes with the future SRL stations". That sounds akin to the 'SRL SmartBus' concepts I proposed here and here.

Priority precincts are named as Fishermans Bend, Arden, Parkville, Sunshine, Richmond to Docklands and Footscray. Fishermans Bend, Sunshine and Footscray (in particular) are heavily served by buses operating under this franchise.

Also, existing services throughout Manningham (eg Doncaster and Balwyn) and Whitehorse (Box Hill and Mitcham) will be reviewed as part of the North-East Link busway and new Park & Ride at Bulleen.

Franchise structure

It is envisaged that there will be three parties. The state (Franchisor), the operator (Franchisee) and a special owner of the fleet and depots (AssetCo). The state has rights over the assets held by AssetCo. Operators have use of the assets via a lease agreement with AssetCo (which is owned by a financier). A franchise agreement governs relationships between the state and the franchisee. Then there's a tripartite agreement binding all three. However operators are invited to make other proposals.

The agreement has an initial 7 year term with a potential 2.5 year extension if the franchisee performs.

Allocation of risks and responsibilities

Who does what? It's a little different to last time. Basically a bit less commercial and a bit more government planning. Some might expect that under a Labor government. However there's been an even bigger swing under the Conservatives in the UK with them effectively abandoning rail franchising.

Network planning and service changes are clearly with the state (in practice the Department of Transport) in this agreement. Provided that they are active in reviewing networks (there were long periods in the '90s and early 2000s when they weren't) this is overall a good thing for reasons described in my earlier post.

However a network view, including potential sharing or swapping of routes between operators is desirable in some areas to deliver the best frequency, connectivity and coverage for the least duplication and cost. That will need some smart leadership to pull off. It's been successfully done before but is today's DoT up to it? Time will tell.

Unambiguously leaving planning with the Department of Transport is a departure from the previous ill-fated arrangement where the franchisee was required to develop a revised greenfields network. Transdev seemed to expect that the state would rubber stamp their poorly consulted on plans of mixed merit. Minister Mulder's easy-going style might have encouraged such a view. However Jacinta Allan, the new minister after the 2014 election, proved a tougher customer and vetoed the whole shebang.

Almost any private business aims to get more customers and make more money. Although public transport is normally a financial loss-maker, the philosophy of operator franchising is about introducing similar commercial pressures as an incentive to boost patronage and improve farebox recovery.

The success of such initiatives depends on the extent to which operators have control over their product and service quality. A major part (and I'd argue the most important part) is whether routes and timetables provide a useful service to as many people as possible. That depends on planning and resourcing, which, as we saw before, now lie with the state. As can happen now the operator can propose improvements through business cases but there is no obligation for government to accept them. And an aversion to political risk may leave some to sit on the shelf, despite the proposal being sound.

Reliability and punctuality are more within the operator's control. But not entirely as buses share the road with cars. Support from other parts of government is needed for bus priority and that might not be a given. Then there's basics like driver hiring, industrial relations, maintenance and cleaning which is pretty much entirely with the bus operator. Competent management can do that, though experience shows that good contract supervision is essential to stop them cutting corners.

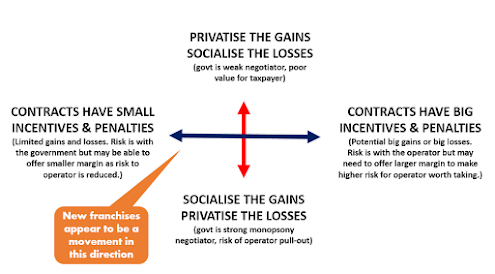

Then there's curve-balls like COVID-19. That's cut patronage, and with it the stability of any contractual arrangements that rely on patronage for a large part of operator revenue. Those writing these contracts know this well. Hence while the contract will reward achievement of a patronage target with a Patronage Incentive Regime (PIR) payment, there will be no penalty if patronage goals are not met. Hence all risk for low patronage remains with the state. I suggested this was probably sensible here.

The other variable payment is the Operational Performance Regime (OPR) dealing with service delivery and time-keeping. That both penalises poor performance and rewards good performance. In both cases the payments are capped. Again this limits downside risk to the operator. The upside limitation might be seen as being less entrepreneurial for the operator but give the government an interest in seeking above-target patronage gains. Which is arguably fair since it also bears all risk.

Other things

Also notable about the revised arrangements:

* Staff conditions are maintained and carried over. Everyone apart from senior management keeps their job under any new franchisee.

* Franchisees must purchase the fleet and depots required (probably via AssetCo). However they must be sold to the state or a successor franchisee at the end of their term for a fixed price. The total worth of these assets (mostly buses and depots) is currently about $145-150m.

* There is a plan for fleet replacement involving approximately 340 new buses over the life of the contract. A graph is presented for procurement out to 2031, with the peak in the 2026 - 2028 period. New buses are promised from 2022 but some deliveries might be pushed later as lead times are tight.

* Depot procurement, ownership and improvements is basically a state government thing, although there may be arrangements with the franchisee in delivery.

* The franchisee is responsible for advertising on buses. Information to come out later. Nothing yet on whether passenger-hostile wrap-style ads that obscure views from windows (and thus wayfinding) will be permitted. Banning this will cost money but has passenger experience benefits.

* Shortlisted respondents need to submit asset management and technical maintenance plans and schedules. You might recall the problems three years ago when it was found that the incumbent franchisee wasn't looking after its buses. They really can't drop the ball on this one.

* Payments to the franchisee will comprise (i) service payments (with potential additions for PIR and additions and subtractions for OPR), (ii) fleet payments and (iii) adjustments for approved service changes based on changes to kilometres and hours operated.

The above came from the general information. Then there's the EOI Returnables document. This is basically to sort out the dabblers from the serious guys. Operating over 500 buses from multiple depots is big business. You only want credible bidders to avoid wasting everyone's time. This form helps establish this by requiring applicants show they have the financial backing, experience and capabilities to be considered. They also have space to explain how they would look after buses and run their depots.

Conclusion

This has been a quick look at where we are with the Metropolitan Bus Franchising process.

Today's context could not be more different from the world-travelling market-grabbing private operator adventurism of twenty or even ten years ago. Recent performance issues with the current bus contract has weakened faith in franchising's ability to deliver benefits. COVID-19 and its recession has eroded transport franchising's underpinnings, even amongst former industry and political backers. Possibly for the first time in their privileged lives they got a big serving of humility; that bigger forces can affect (and sometimes end) our lives in ways thought either impossible or unlikely a few short years ago.

Operators and their managers are now likely more risk-averse, having seen patronage drops beyond any plausible worst case scenario. What was accepted wisdom with regard to commercial incentives and transport franchising is beating a hasty retreat, most notably in the country that spawned it. For businesses involved in the sector a steady consistent income at a lowish return from a financially-sound government is more attractive than schemes that promise massive gains but carry with them huge risks.

It would appear that despite the commercial-sounding name of 'franchise', the new agreements will be somewhat less commercial than today's. This reduces risk for the operator but presents other issues. For example if not actively managed it could mean a continuation of the stagnation in network reform seen since about 2016. With it now bearing full risks for patronage losses and having full charge of service planning, all eyes will be on the Department of Transport to plan and commission the simpler, more direct and more frequent networks that areas served by this franchise need. And unlike last time there is now no ambiguity with whom this responsibility lies.

Melbourne on Transit bookshop

Favourably reviewed books about transport and cities. Purchases via these links support this blog and its independent reporting (at no extra cost to you).