Those per kilometre figures correct for service levels. But I did not correct for inflation. That's important if you're comparing 20 years of figures. Especially if you're interested in value for money.

Which everyone should be, given (i) Melbourne's population and need for transport is growing, (ii) the government says it's broke and (iii) we are in a service per capita recession for our busiest PT modes.

Melbourne's record on service

Melbourne's pipped Sydney as Australia's biggest city. However Sydney has added a lot more PT frequency in the last decade. That really got started under the previous NSW Coalition government and has continued under Labor. During this time Victoria's Labor government pursued a 99% infrastructure-based 'shovels not service' policy, with frequency improvements rare in metropolitan Melbourne.

Hence it's now common for waits for trains and trams in Melbourne to be double Sydney's, particularly nights. To quote The Commercial Advisory Partnership (a consultancy specialising in transport franchising), '..investments in hard assets mean nothing unless they translate into better services'.

Melbourne's per capita PT service slump is deepest for trams, with this falling by over 20% in 20 years. Declining tram service has been a multi-generational megatrend; go back 70 years and waits for trams were half today's. Absolute declines in service ceased maybe 30 years ago but per capita declines have continued and possibly even accelerated when inner area densification is counted. Tram service is topical today as the current operating franchise expires this year and the government is currently evaluating franchise bids from aspirant operators.

Also last week the government exercised its option to extend the metropolitan rail franchise by 18 months to enable bedding down of Metro Tunnel operations. While we're promised more services under the Metro Tunnel associated timetables, there is uncertainty over whether these will go beyond the lines directly served by the Metro Tunnel, with the Minister at PAEC recently refusing to be drawn on whether busy lines like Craigieburn will benefit off-peak.

Government sensitivity on service matters can be measured by the frequency by which the Minister quotes the 2000/20000 number to sell the government's record. That is the addition of 2000 rail services and 20000 bus services since the current government took office in 2014. This was later confirmed (as in the abovementioned PAEC hearing) to mean services per week, which was a welcome clarification.

However counting service numbers (as opposed to service hours or kilometres) is not the best measure of service uplift. This is because on this metric adding a 4 hour trip on an orbital route counts the same as a 10 minute ride on a university shuttle, despite a >20:1 difference in service hours and thus resource usage.

If a high proportion of services added have been on shorter than average routes (which is true given the government's strong record of adding or boosting short routes like 201, 202 and 301 university shuttles and 235 / 237 in Fishermans Bend) then a trip count method will exaggerate the quantity of service added. Conversely the method would unfairly downplay highly desirable boosts to long routes eg orbital SmartBus weekend frequencies (which the government hasn't done much of).

This, and its accurate treatment of network reform (which may split or join routes), is why the Department of Treasury & Finance method of counting annual service kilometres per mode as reported in the budget papers and discussed by me here is a sounder measure of service provision and trends. Thus, unless one is talking about a service uplift to one line or route only, quoting the number of added services is of only limited usefulness.

Payment differences

Are we paying more per service kilometres than we were 10 or 20 years ago? To find out I converted each year's per service kilometre budget costs to a 2005 base using CPI numbers via macrotrends.net. There'll be variations but CPI prices today are roughly 1.6 times what they were in 2005.

Here's what I arrived at.

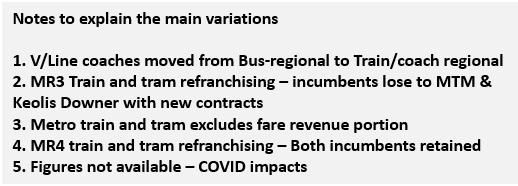

However it seems that the relative cost increase for V/Line is lower than Metro Trains. And trams have grown even faster. However in both the metropolitan modes the biggest step change in real costs appears to be that following the 2009 refranchising (or before that in 2004, coming off unrealised assumptions regarding efficiency gains, patronage and diminishing subsidy from the first round of franchising).

Experience has shown that there are both good and poorly performing public and private operators. Initial cost savings from a private tender may evaporate over time, with operators either walking out, cutting corners or being retained under more generous terms. And the apparent accountability of a government operator might not necessarily mean superior service in practice, such as the stagnation in both rail and bus service levels in Brisbane. Those most heated about private franchise versus nationalised operations tend to be more loyal to their political ideologies than what is working well for passengers at a particular time.

Given that Victoria has opted for a franchise model for its metropolitan transport, any work DTP does to sharpen its pencil and get more from franchisees so more can be put into service could be a wise investment given (a) the current government's reluctance to find money for significant metropolitan train and tram service increases and (b) the big cuts to maximum waits possible with as little as 1% more services added to the weekly timetable (but preferably more).

No comments:

Post a Comment